Tax savings 401k contribution calculator

This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. It provides you with two important advantages.

Free 401k Calculator For Excel Calculate Your 401k Savings

This calculator uses the withholding schedules rules and rates from IRS Publication 15.

. This calculator helps you estimate the earnings potential of your contributions based on the amount you invest and the expected rate of annual return. For example if you are single and make 80k of normal income without any 401k contributions your federal income tax would be 10775 in 2019. Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo.

During retirement they would have a higher combined after-tax monthly income of 6091 from the Roth 401 k versus 5706 from the Regular 401 k. Use this calculator to see how increasing your contributions. Select a state to.

Your 401 k contributions directly reduce your taxable income at the time you make them because theyre typically made with pre-tax dollars. Step 1 Determine the initial balance of the account if any and also there will be a fixed periodical amount that will be invested in the 401 Contribution which would be maximum. You can only contribute income that is reported on your W-2.

A 401k is a retirement savings account available through for-profit employers. You live in a mid-sized city lets say Tulsa Oklahoma where you earn. With 19k contributed to a traditional 401k.

You can elect to contribute the annual maximum limit of 18000 or 24000 if. Use this 401k calculator to figure out how your income employer matches taxes and other factors will affect how your 401k grows over time. This 401k contribution calculator helps streamline the process of figuring out how much you should contribute toward your 401k to meet your future goal.

35000 - 2100 32900. Rules for Contributing to an S-Corp 401 k 3. Pre-Tax Savings Calculator Enter your information below Tax Year 2022 Filing Status Annual Gross Income prior to any deductions Itemized Deductions If 0 IRS standard deduction.

Our free 401k Calculator for Excel can help you estimate how much you could have after investing for a certain number of years. It simulates that if you. Many employers provide matching contributions to your account which can range from 0 to 100 of your contributions.

The tax savings related to. Anything your company contributes is on top of that limit. Personal Investor Profile Download.

Use this contribution calculator to help you determine how much you will have saved in your 401k fund when you retire. Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings. 35000 x 006 2100.

In 2022 you can contribute 20500 to a 401 k. When you contribute 6 of your salary into a tax-deferred 401 k 2100your taxable income is reduced to 32900. Youll pay taxes on less income as a result.

This calculator allows employees to deduct 401 k or 403 b contributions for tax year 2022. Definition of a 401k Account. State Date State Federal.

64000 appears above the. Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings. Use this calculator to figure out how much you should be saving for retirement and to estimate what your 401k will.

First all contributions and earnings to. This calculator has been. Those who are 50 years or older can invest 6500 more or 27000.

Use this calculator to see how increasing your contributions to a. Use this calculator to see how increasing your contributions to a 401k can affect your paycheck and your retirement savings. It takes into account your existing balance annual.

When you make a pre-tax contribution to your.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Traditional Vs Roth Ira Calculator

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Retirement Withdrawal Calculator For Excel

401k Calculator

Microsoft Apps

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Traditional Vs Roth Ira Calculator

401 K Calculator See What You Ll Have Saved Dqydj

Traditional Vs Roth Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Free 401k Calculator For Excel Calculate Your 401k Savings

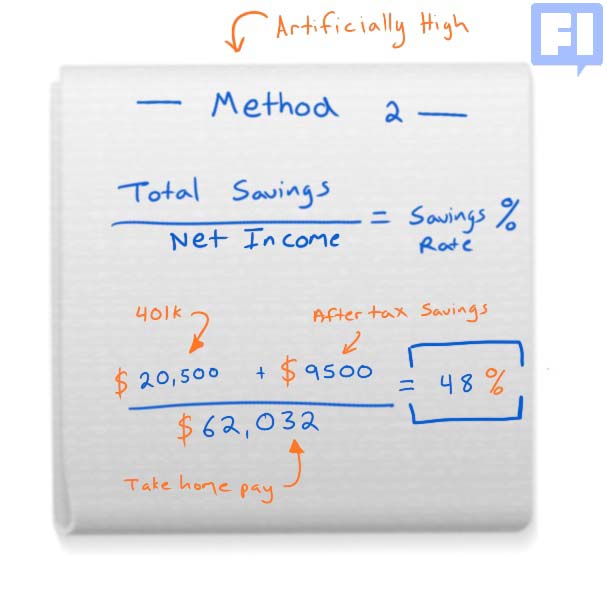

How To Calculate Your Savings Rate And Why It S Important Choosefi

Retirement Services 401 K Calculator

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Retirement Calculator Spreadsheet Budget Template Retirement Calculator Simple Budget Template

401k Contribution Calculator Step By Step Guide With Examples